Refer to Scenario 17.4. Moral hazard arises in this situation because once the firm

A) pays the premium that is based on the .005 probability, it has no incentive to spend the additional $1000 for the flood control system, so the true probability of loss is no longer .005.

B) pays the premium that is based on the .01 probability, it has no incentive to spend the additional $1000 for the flood control system, so the true probability of loss is no longer .01.

C) provides for flood control, it has less incentive to spend $5000 on premiums, leaving itself underinsured.

D) provides for flood control, it has less incentive to spend $10,000 on premiums, leaving itself underinsured.

E) provides for flood control, it will consider that a substitute for insurance and not be able to deal with the loss from a flood should it occur.

A

You might also like to view...

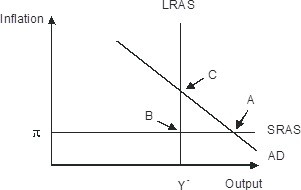

The economy pictured in the figure has a(n) ________ gap with a short-run equilibrium combination of inflation and output indicated by point ________.

A. recessionary; A B. recessionary; C C. recessionary; B D. expansionary; A

When investment banks buy or sell securities on their own account, it's called

A) financial engineering. B) proprietary trading. C) underwriting. D) factoring.

As long as there is some substitution effect in response to a change in the relative price of a good, there will be an excess burden from a tax

a. True b. False

The largest component of the U.S. GDP is:

A. C B. I C. G D. NX