How do constraints on monetary policy in the United States differ from those experienced by euro zone countries?

What will be an ideal response?

United States monetary policy constraints are quite different from those encountered by countries in the euro zone. The US can print dollars to pay off debts as necessary and, while the result might be a higher rate of inflation, it makes it virtually impossible for the US to default on its public debts. Euro countries have a European Central Bank that must make decisions regarding monetary policy that will affect all of the euro zone countries. One possibility that has been discussed is to make it possible to conditionally remove countries from the euro zone to prevent the destruction of the monetary union. Note that this would be equivalent to the United States deciding to remove a state from the union if the state threatened bankruptcy.

You might also like to view...

Refer to Table 8-17. What is nominal GDP in 2011?

A) $3,320 B) $3,690 C) $6,360 D) $7,035

The existence of an inflationary gap would tend to benefit most

A. bankers. B. retired persons. C. unemployed workers. D. stock owners.

A price-taking firm's variable cost function is C = Q3, where Q is the output per week. It has an avoidable fixed cost of $1,024 per week. Its marginal cost is MC = 3Q2. What is the profit maximizing output if the price is P = $192?

A. 0 or 5.33 or 8 B. 5.33 or 8 C. 0 or 5.33 D. 0 or 8

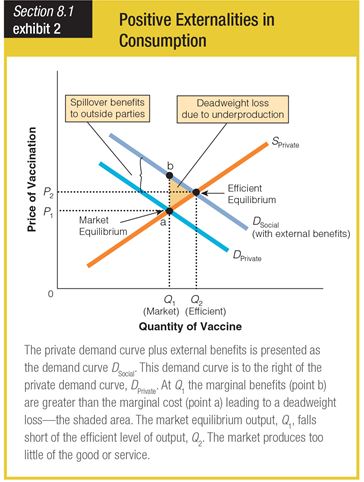

In this graph for positive externalities in consumption, the deadweight loss is caused by ______.

a. government intervention

b. defective products

c. overproduction

d. underproduction