Genelia holds shares in a motorcycle manufacturing company. Genelia gets a stated amount of dividend from the company only if the board of directors declares it. In this case, Genelia is a(n) _____.

A. exchange trader

B. preferred stockholder

C. full-service stock broker

D. trade union partner

Answer: B

You might also like to view...

A good résumé is targeted for specific situations and prospective employers

Indicate whether the statement is true or false.

Seal Financial Advisors provides accounting and finance assistance to customers in the retail business. Seal has four professionals on staff and an office with six clerical staff. Total compensation, including benefits, for the professional staff runs about $571,000 per year, and normal billable hours are 8100 hours per year. The professional staff keep detailed time sheets organized by client number. The total office and administrative costs for the year are $754,000. Seal allocates office and administrative costs to clients monthly, using a predetermined overhead allocation rate based on billable hours. What is the predetermined overhead allocation rate that Seal will use for office and administrative costs? (Round your answer to the nearest cent.) A) $93.09 per hour

A) $93.09 per hour B) $22.59 per hour C) $70.49 per hour D) $163.58 per hour

Baird Company reported depreciation expense of $10,000 and net income of $16,000 on its Year 2 income statement. During Year 2, the company's accounts receivable balance decreased by $4,000. Based on this information alone, what was the amount of cash flow from operating activities?

A. $32,000 B. $16,000 C. $30,000 D. $12,000

Answer the following statements true (T) or false (F)

1. When preparing the statement of cash flows using the indirect method, a loss on the sale of plant assets must be shown as a subtraction from the investing activities section.

2. When preparing the statement of cash flows using the indirect method, a decrease in current liabilities is added to the net income to arrive at net cash provided by operating activities.

3. While preparing a statement of cash flows using the indirect method, an increase in current assets is added to net income to arrive at net cash provided by operating activities.

4. The change in Accounts Receivable is shown as a negative cash flow in the adjustments to net income.

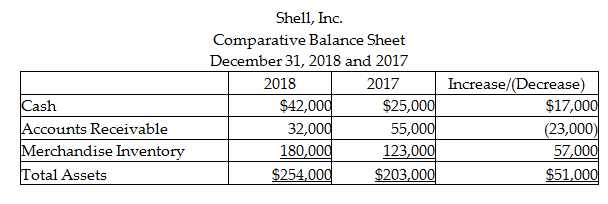

Shell, Inc. uses the indirect method to prepare the statement of cash flows. Refer to the following section of the comparative balance sheet: