Why might people object to a regressive tax structure?

What will be an ideal response?

A regressive tax requires people with a higher income to pay a lower fraction of their income in taxes. Many people believe that equity demands that people with a greater capacity to pay taxes should pay a larger percentage of their income in taxes, not a smaller percentage. This would make after-tax incomes more equal, which some people believe is a morally desirable result.

You might also like to view...

In a competitive market free of government regulation,

A. price adjusts until quantity demanded is less than quantity supplied. B. supply adjusts to meet demand at every price. C. price adjusts until quantity demanded is greater than quantity supplied. D. price adjusts until quantity demanded equals quantity supplied.

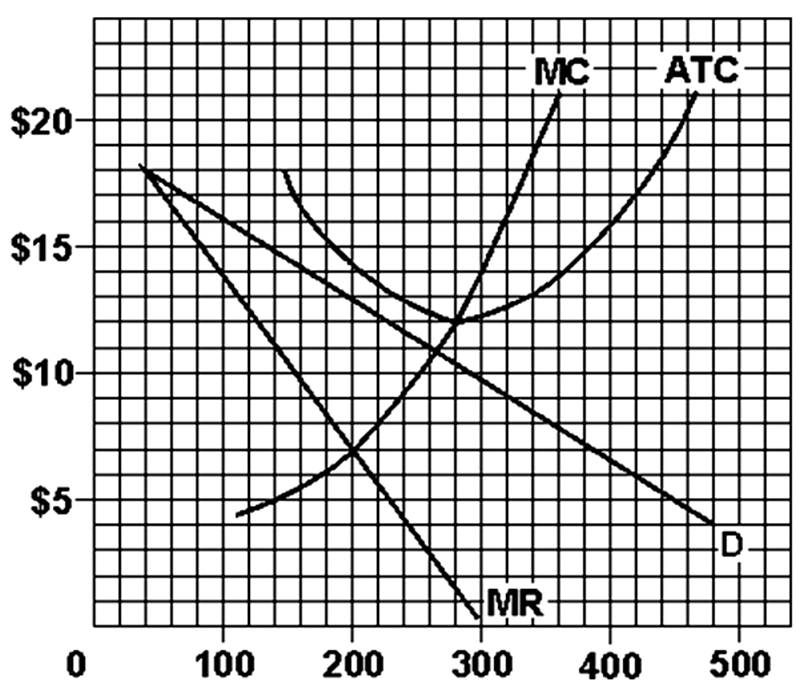

If this firm were a perfect competitor, it would produce at _____ units of output and charging a price of _______.

A. 200; $7.00.

B. 200; $12.80.

C. 280; $10.40.

D. 280; $12.00.

There is no relationship between the price level and which component of GDP?

A. C B. NX C. G D. I

If a major league baseball player would be willing to work for $700,000 per year and is currently being paid $1,200,000 per year, that player is earning an annual economic rent of

A. $1,900,000. B. $700,000. C. $500,000. D. $1,200,000.