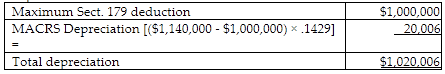

Terra Corporation, a calendar-year taxpayer, purchases and places into service machinery with a 7-year life that costs $1,140,000. It was placed in service early in the year and was the only addition this year. Terra elects to depreciate the maximum under Sec. 179 and does not apply bonus depreciation. Terra's taxable income for the year before the Sec. 179 deduction is $1,700,000. What is

Terra's total depreciation deduction related to this property?

A) $1,140,000

B) $1,020,006

C) $162,906

D) $1,028,000

B) $1,020,006

You might also like to view...

Under the effective interest method of amortization, the interest expense for each period is the carrying value times the ______________________

Fill in the blank(s) with correct word

Using the ________ level of the product hierarchy to market its soups, Campbell Soups feature the company name first, then the soup variety on their packaging

A) product class B) product-type C) need-family D) product-family E) product-line

At Home Service, Inc., employees stay with the organization for many years and develop skills on the job that help Home Service, Inc. become more efficient. This is consistent with Fayol's principle of

A. stability of tenure. B. order. C. discipline. D. unity of command. E. unity of direction.

Describe the impact of the EU on the non-EU firm.

What will be an ideal response?