The commercial banks in Lendland have

Reserves $400 million

Loans $3,600 million

Deposits $4,000 million

Total assets $4,600 million

The banks hold no excess reserves.

a) Calculate the banks' reserve ratio.

b) An immigrant arrives in Lendland with $5 million, which he deposits in a bank. How much does the immigrant's bank lend initially?

a) With no excess reserves, the desired reserve ratio is the fraction of banks' total deposits that are held in reserves. So in Lendland, the banks' desired reserve ratio is 400/4000 = 0.1 or 10 percent.

b) With a desired reserve ratio of 10 percent, the bank keeps $5 million × 0.10 = $0.5 million on reserve. It then lends the rest, so it lends $5 million - $0.5 million, which is $4.5 million.

You might also like to view...

Rent seeking is the act of obtaining special treatment by ________ to create ________

A) a monopoly; consumer surplus B) the government; economic profit C) consumers; a monopoly D) the government; consumer surplus E) competitive producers; a monopoly

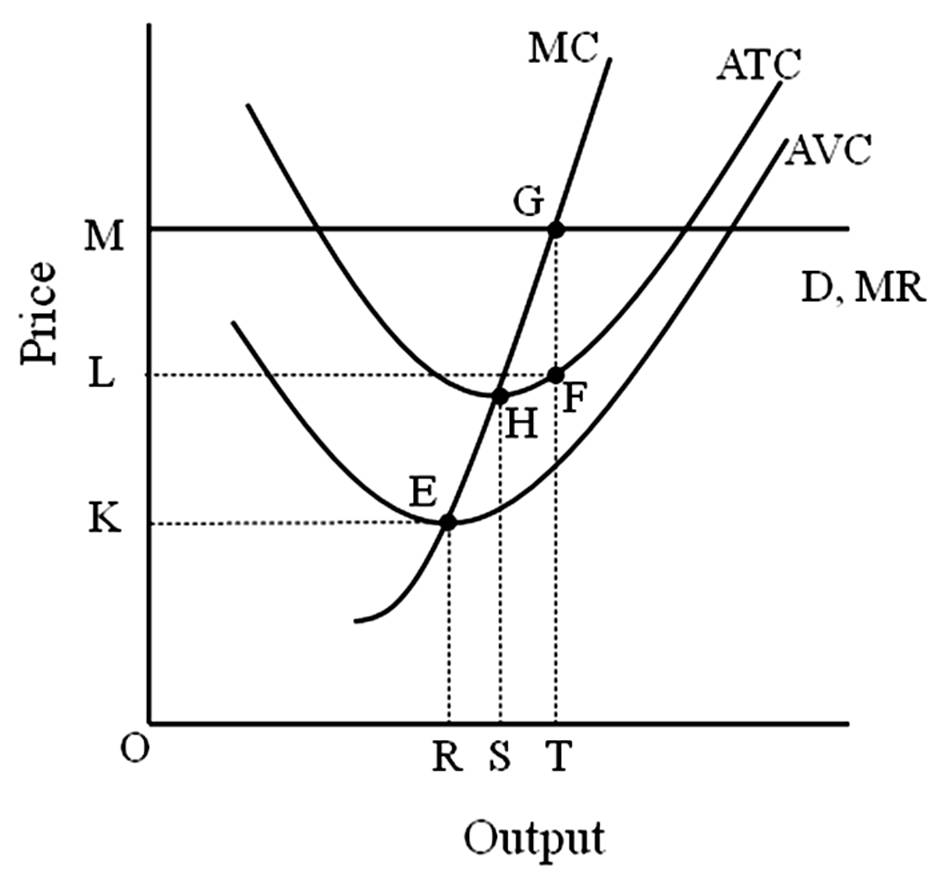

Using only marginal revenue and marginal cost, we can determine whether a firm is incurring a profit or a loss.

Answer the following statement true (T) or false (F)

Profit per unit is

A. TF.

B. TG.

C. SH.

D. GF.

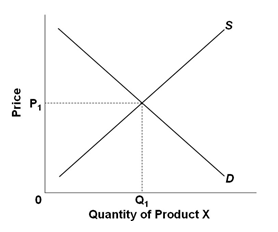

Refer to the supply and demand graph of Product X below. What would happen if the government decided to also start providing Product X in the market?

A. Demand would decrease

B. Demand would increase

C. Supply would decrease

D. Price would decrease