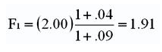

The risk-free interest rate in the United States is 4%, while the risk-free interest rate in the United Kingdom is 9%. If the British pound is worth $2 in the spot market, a 1-year futures rate on the British pound should be worth __________.

A. $1.83

B. $1.91

C. $2.08

D. $2.18

B. $1.91

You might also like to view...

Which of the following statements is an advantage of statistical designs?

A) The effects of more than one independent variable can be measured. B) Specific extraneous variables can be statistically controlled. C) Economical designs can be formulated when each test unit is measured more than once. D) All of the statements are advantages.

With two autonomous division managers, the price of goods transferred between the divisions needs to be approved by

a. corporate management. b. both divisional managers. c. both divisional managers and corporate management. d. corporate management and the manager of the buying division.

Financial information provides managers with sufficient information to measure the four building blocks of competitive advantage.

Answer the following statement true (T) or false (F)

Use the information in Figure K.1. What is the rectilinear distance between offices A and C?

A) less than or equal to 25 feet B) greater than 25 but less than or equal to 45 feet C) greater than 45 but less than or equal to 65 feet D) greater than 65 feet