What is the expected return on a stock with a beta of 1.09, a market risk premium of 8%, and a risk-free rate of 4%?

A) 4.36%

B) 8.36%

C) 8.72%

D) 12.72%

Answer: D

You might also like to view...

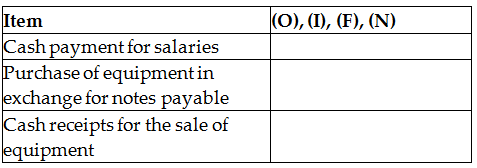

Identify how each of the following items is shown on the statement of cash flows. Identify each as operating (O), investing (I), financing (F), or non-cash investing and financing (N).

Sometimes employees view management decisions differently than managers do. This is an example of ______.

a. selectivity bias b. stereotyping bias c. frame of reference bias d. expectations bias

If a business sells two products, it is not possible to estimate the break-even point

Indicate whether the statement is true or false

With what type of reduction do companies cut the hours available to each worker but don’t lose any workers?

A. Job hoteling B. Work sharing C. Hours express D. Hourly forecasting E. Absence management