Ed and his wife Edna gave their daughter $24,000. There are no potential estate taxes on this gift

Indicate whether the statement is true or false.

TRUE

You might also like to view...

The correct net income for Sarah Corp was $53,500. However, the company reported incorrect net income because beginning inventory was understated by $2,500, purchases were overstated by $2,000, and ending inventory was overstated by $2,000. What net income did Sarah Corp report?

A) $49,000 B) $51,000 C) $56,000 D) $58,000

Low verbal immediacy is intended to engage or compel the other party, while high verbal immediacy is intended to create a sense of distance or aloofness.

Answer the following statement true (T) or false (F)

José works for a company where he is given the freedom to decide how best to carry out the tasks assigned to him. It can be said that José's job has high

A. skill variety. B. autonomy. C. task significance. D. feedback. E. task identity.

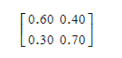

Calculate the steady-state probabilities for this transition matrix.

What will be an ideal response?