What is the random walk theory?

What will be an ideal response?

The random walk theory is the theory that prices of stocks move independently in securities markets and, hence, that there are no predictable trends that can be used to make riskless profits. The theory assumes that information about companies and stocks quickly are processed by the market and reflected in changed prices. This process happens so fast that no one can generate riskless profits.

You might also like to view...

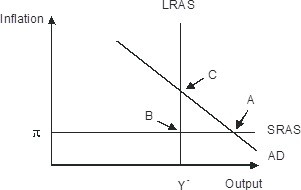

The economy pictured in the figure has a(n) ________ gap with a short-run equilibrium combination of inflation and output indicated by point ________.

A. recessionary; A B. recessionary; C C. recessionary; B D. expansionary; A

In a monopolistically competitive market with Dixit-Stiglitz preferences, equilibrium price falls as the goods in the differentiated product market become more substitutable.

Answer the following statement true (T) or false (F)

When the U.S. price level increases, we would expect a:

A. movement downward along the aggregate demand curve. B. movement up along the aggregate demand curve. C. shift to the right of the aggregate demand curve. D. shift to the left of the aggregate demand curve.

Inflation distorts savings when real interest income, rather than nominal interest income, is taxed

a. True b. False Indicate whether the statement is true or false