Diamond, Inc purchased a machine under a deferred payment contract on December 31 . 2013 . Under the terms of the contract, Diamond is required to make eight annual payments of $140,000 each beginning December 31 . 2014 . The appropriate interest rate is 8 percent. The purchase price of the machine is

a. $1,389,190.

b. $1,120,000.

c. $868,900.

d. $804,530.

D

You might also like to view...

Which of the following statements is TRUE?

A) Accounts receivable are more liquid than cash. B) Notes receivable are always classified as current assets. C) Notes receivable usually have longer collection terms than accounts receivable. D) Accounts receivable are liabilities.

David looks to his coworkers when determining whether or not he should obey the company’s code of ethics. He is reasoning at which level?

A. conventional B. preconventional C. postconventional (principled) D. none of these

A small business uses the accrual method of accounting for its financial statements. It must also use the accrual method for computing taxable income.

Answer the following statement true (T) or false (F)

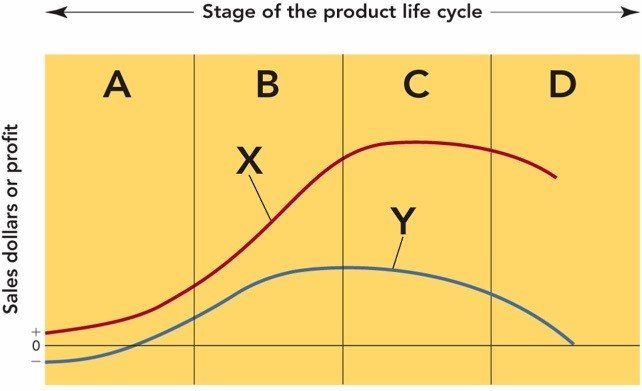

Figure 10-1Figure 10-1 above represents the stages of the product life cycle. What does the portion of the curve labeled A represent?

Figure 10-1Figure 10-1 above represents the stages of the product life cycle. What does the portion of the curve labeled A represent?

A. growth B. introduction C. maturity D. launch E. preparation