The majority of economists would argue that an increase in taxes

A. has little or no effect on savings.

B. dramatically decreases savings.

C. slightly increases savings.

D. dramatically increases savings.

Answer: A

You might also like to view...

A shift occurs in the supply curve for salt when:

a. the price of salt increases. b. improvements are made in the production process. c. salt is found to be associated with high blood pressure. d. consumers expect the price of salt to increase in the future.

Heavy advertising expenditures usually indicate

a. oligopoly. b. pure competition or monopolistic competition. c. oligopoly or monopoly. d. differentiated pure competition or monopoly.

Mathematically, the value of the tax multiplier in terms of the marginal propensity to consume (MPC) is given by the formula:

A. MPC ? 1. B. (MPC ? 1) / MPC. C. 1 / MPC. D. 1 ? [1 / (1 ? MPC)].

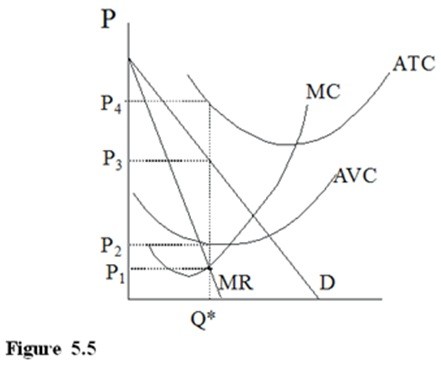

In Figure 5.5, a monopolist would charge which price?

A. P1 B. P2 C. P3 D. P4