A bank's assets consist of $1,000,000 in total reserves, $2,100,000 in loans, and a building worth $1,200,000 . Its liabilities and capital consist of $3,000,000 in demand deposits and $1,300,000 in capital. If the required reserve ratio is 10 percent, what is the level of the bank's excess reserves? How much could it loan out as a result?

a. $700,000; $700,000

b. $700,000; $7,000,000

c. $300,000; $300,000

d. $300,000; $3,000,000

a

You might also like to view...

Under conditions of perfect competition, if any one producer increases output,

a. market price rises. b. market price falls. c. market price does not change. d. market price changes unpredictably up or down.

The main advantage of using panel data over cross sectional data is that it

A) gives you more observations. B) allows you to analyze behavior across time but not across entities. C) allows you to control for some types of omitted variables without actually observing them. D) allows you to look up critical values in the standard normal distribution.

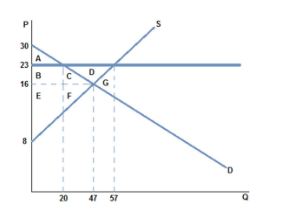

A binding price floor that could be set in the market in the graph shown would be:

A. $23.

B. $16.

C. $8.

D. $12.

One way the government can boost the economy out of a recession is:

A. with public announcements telling the public to save their money. B. by increasing government spending. C. by setting price ceilings on most goods so people can afford them. D. None of these will help an economy in recession.