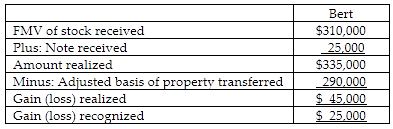

Individuals Bert and Tariq form Shark Corporation. Bert transfers equipment with a $290,000 adjusted basis and a $335,000 FMV for 50% of the stock worth $310,000 and a note of Shark Corporation valued at $25,000. Tariq transfers cash of $335,000 in exchange for 50% of the stock of Shark Corporation worth $310,000 and a $25,000 note. Bert's recognized gain is

A) $0.

B) $20,000.

C) $25,000.

D) $45,000.

C) $25,000.

Bert's recognized gain is the smaller of his realized gain of $45,000 [$335,000 - $290,000] or $25,000 of boot received [note of the Shark Corporation].

You might also like to view...

A company has 800 shares of $50 par value preferred stock outstanding, and the call price of its preferred stock is $62 per share. It also has 18,000 shares of common stock outstanding, and the total value of its stockholders' equity is $656,200. The company's book value per common share equals:

A. $34.23. B. $36.46. C. $34.90. D. $32.27. E. $33.70.

Which of the following is NOT considered to be an equitable remedy?

A) Specific performance B) Injunction C) Reformation D) Money damages

The management of Bullinger Corporation would like to investigate the possibility of basing its predetermined overhead rate on activity at capacity. The company's controller has provided an example to illustrate how this new system would work. In this example, the allocation base is machine-hours and the estimated amount of the allocation base for the upcoming year is 9,000 machine-hours. Capacity is 12,000 machine-hours and the actual level of activity for the year is assumed to be 7,700 machine-hours. All of the manufacturing overhead is fixed and both the estimated amount at the beginning of the year and the actual amount at the end of the year are assumed to be $11,880 per year. For simplicity, it is assumed that this is the estimated manufacturing overhead for the year as well as the

manufacturing overhead at capacity. It is further assumed that this is also the actual amount of manufacturing overhead for the year. If the company bases its predetermined overhead rate on the estimated amount of the allocation base for the upcoming year, then the predetermined overhead rate is closest to: A. $1.32 per machine-hour B. $1.54 per machine-hour C. $0.99 per machine-hour D. $1.49 per machine-hour

The issuing bank will honor the draft as long as the documents appear to be in good order on their face and correspond to the terms of the letter of credit, regardless of the conditions of the goods received

Indicate whether the statement is true or false