The Stability and Growth Pact (SGP) of 1997 proposed:

A) only a budgetary surveillance process.

B) no sanctions for "excessive deficit procedure."

C) signing mandatory pledges to uphold the criteria.

D) a budgetary surveillance process and sanctions for "excessive deficit procedure."

Ans: D) a budgetary surveillance process and sanctions for "excessive deficit procedure."

You might also like to view...

Which of the following is an appropriate discretionary fiscal policy if equilibrium real GDP falls below potential real GDP?

A) an increase in the supply of money B) an increase in individual income taxes C) a decrease in transfer payments D) an increase in government purchases

The U.S. federal income tax is progressive, which means that _____.

a. tax receipts grow at the same rate that income does b. tax receipts grow at the same rate that government spending does c. middle-income individuals pay more in taxes than either high-income or low-income individuals d. the tax rate decreases with increases in income e. high-income individuals are taxed at a higher rate than low-income individuals

Which tax system requires all taxpayers to pay the same percentage of their income in taxes?

a. a regressive tax b. a proportional tax c. a progressive tax d. a horizontal equity tax

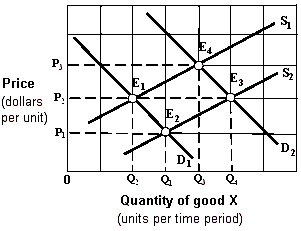

Exhibit 4-2 Supply and demand curves

A. A decrease in input prices. B. A decrease in consumer prices. C. An increase in input prices. D. An increase in consumer income.