Tax incidence refers to

A) determining who sends the taxes into the government.

B) the tendency of some people to avoid paying taxes at all.

C) the distribution of tax burdens among groups, or who really pays a tax.

D) determining the marginal tax rate applied to any increase in income.

Answer: C

You might also like to view...

Give an example of price discrimination

What will be an ideal response?

The motivation for collective action is to do things that benefit society as a whole

a. True b. False

A person who works part-time is considered to be:

a. employed b. unemployed. c. out of the labor force. d. overemployed.

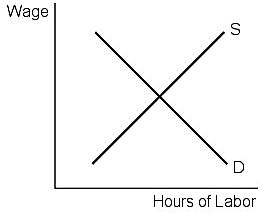

In Figure 10.3, an increase in the supply of labor will cause the equilibrium:

In Figure 10.3, an increase in the supply of labor will cause the equilibrium:

A. wage and hours of labor used to increase. B. wage and hours of labor used to decrease. C. wage to increase and hours of labor used to decrease. D. wage to decrease and hours of labor used to increase.