In 2019, John (52 years old) files as a head of household with one 18-year old dependent (qualifying) child. John is eligible to claim a $700 American opportunity credit for the year. John did not have any taxes withheld by his employer during the year and he did not make any estimated tax payments. After taking credits into account, what is the amount of John's taxes payable or refund, assuming that his AGI is $26,000 (all from salary) and his taxable income is $8,000?

What will be an ideal response?

Refund of $2,412.

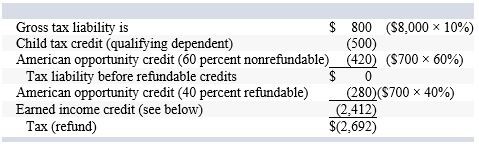

Answer computed as follows:

Note: the $500 child tax credit is nonrefundable.

Earned income credit computation

| Description | Amount | Explanation | |||

| (1) | Greater of AGI or earned income | $ | 26,000 | AGI = earned income | |

| (2) | Maximum earned income eligible for earned income credit for taxpayers filing as single with one qualifying child | 10,370 | |||

| (3) | Earned income eligible for credit | 10,370 | Lesser of (1) or (2) | ||

| (4) | Earned income credit percentage for taxpayer with one qualifying child | 34 | % | ||

| (5) | Earned income credit before phase-out | 3,526 | (3) × (4) | ||

| (6) | Phase-out threshold begins at this level of earned income | 19,030 | |||

| (7) | Earned income in excess of phase-out threshold | 6,970 | (1) - (6) | ||

| (8) | Phase-out percentage | 15.98 | % | ||

| (9) | Credit phase-out amount | (1,114 | ) | (7) × (8) | |

| Earned income credit after phase-out | $ | 2,412 | (5) + (9) | ||

You might also like to view...

Which stage in the consumer purchase decision process suggests criteria to use for the purchase, yields brand names that might meet the criteria, and develops consumer value perceptions?

A. information search B. purchase decision C. postpurchase evaluation D. alternative evaluation E. problem recognition

Typically, negotiators first meet with their constituency at the front table to define their collective interests and objectives, and then meet with opposing negotiators at the back table.

Answer the following statement true (T) or false (F)

The Neron Company's net income for the year ended December 31 was $30,000 . During the year, Neron declared and paid $3,000 in cash dividends on preferred stock and $5,250 in cash dividends on common stock. At December 31 . 36,000 shares of common stock were outstanding, 30,000 of which had been issued and outstanding throughout the year and 6,000 of which were issued on July 1 . There were no

other common stock transactions during the year, and there is no potential dilution of earnings per share. What should be the year's basic earnings per common share of Neron, rounded to the nearest penny? a. $0.66 b. $0.75 c. $0.82 d. $0.91

Google has just declared a dividend of $2.12 on its common stock. Dividends are paid annually. Dividends are expected to grow at the rapid pace of 10% for the next 4 years, after which growth is expected to slow to 3% per annum forever

During the rapid growth phase, the required return on this investment will be 20%, and it is expected to drop to 12% when growth slows. What is the current market value of this stock? A) $19.73 B) $23.98 C) $25.33 D) $29.43 E) $74.70