Falling interest rates can

A) raise the cost of buying new homes and fewer new homes will be purchased.

B) lower the cost of buying new homes and fewer new homes will be purchased.

C) raise the cost of borrowing for firms and decrease investment.

D) increase a firm's stock price, which causes firms to issue more stock shares, and thus increases funds for investment.

D

You might also like to view...

If the inverse demand curve a monopoly faces is p = 100 - 2Q, MC is constant at 16, and the government imposes an $8 per unit specific tax on the monopoly, the deadweight loss solely due to the tax is

A) $88. B) $152. C) $361. D) $441.

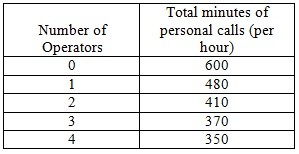

An agency is having problems with personal phone calls made during working hours. Each minute of a personal call costs the agency $0.50 in wasted wages. The agency hires operators to monitor calls in order to attain the optimal number of personal calls (minimize total cost of personal calls). Based on the above information, if operators receive $25 an hour, how many operators should the agency hire?

Based on the above information, if operators receive $25 an hour, how many operators should the agency hire?

A. 0 B. 1 C. 2 D. 3 E. 4

If a unit excise tax is placed on a good for which the demand is very unresponsive to a price change, then

A. producers and consumers pay equal portions of the tax. B. the consumers generally pay the majority of the tax. C. the producers generally pay the majority of the tax. D. the government generally pays the majority of the tax.

A decrease in taxes would cause:

A. the dynamic aggregate demand curve to shift to the right. B. the dynamic aggregate demand curve to shift to the left. C. a movement up and along the existing dynamic aggregate demand curve. D. a movement down and along the existing dynamic aggregate demand curve.