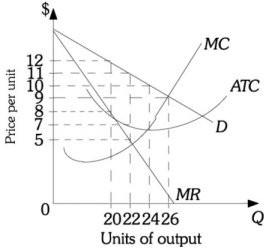

Refer to the information provided in Figure 13.4 below to answer the question(s) that follow.  Figure 13.4Refer to Figure 13.4. The profit-maximizing price for this firm is

Figure 13.4Refer to Figure 13.4. The profit-maximizing price for this firm is

A. $5.

B. $7.

C. $9.

D. $11.

Answer: D

You might also like to view...

A 5 percent tax is going to be applied to a $100,000 tax base. What can be said about the revenue collected assuming static tax analysis?

A) The total revenue will be zero. B) The total revenue will be between $0 and $5,000. C) The total revenue will be $5,000. D) There is not enough information to determine what revenues will equal.

The multiplier effect is most potent when ______.

a. expenditures on one type of resource are replaced by another b. idle resources are brought into production c. it makes productive resources idle d. all economic resources are already fully employed

Correcting a market with an externality through taxation creates ________ total surplus compared to correcting it through a quota.

A. the same B. more C. less D. Any of these statements could be true depending on whether the tax is imposed on the buyer or seller.

Quantitative easing involves all of the following except:

A. higher asset prices. B. Lower long-term interest rates. C. higher long-term interest rates. D. Purchasing longer-term bonds.