When a financial asset is first sold, the sale takes place in the ________ market, and subsequent sales take place in the ________ market

A) secure; risk B) stock; bond

C) investment; commercial D) primary; secondary

D

You might also like to view...

If the reserve requirement is 20% and commercial bankers decide to hold additional excess reserves equal to 5% of any newly acquired checkable deposits, then the effective monetary multiplier for the banking system will be

A. 3. B. 4. C. 5. D. 6.

Assume we have a simplified banking system in balance-sheet equilibrium. Also assume that all banks are subject to a uniform 10 percent reserve requirement and demand deposits are the only form of money. A commercial bank receiving a new demand deposit of $100 would be able to extend new loans in the amount of:

a. $10 b. $90. c. $100 d. $1,000.

Gross Domestic Product measures the market value of:

a. all final goods and services produced in the United States in a year. b. all goods and services produced by the private sector of the economy. c. only manufactured goods made for U.S. consumers. d. only services produced by U.S. owned companies with facilities in the United States.

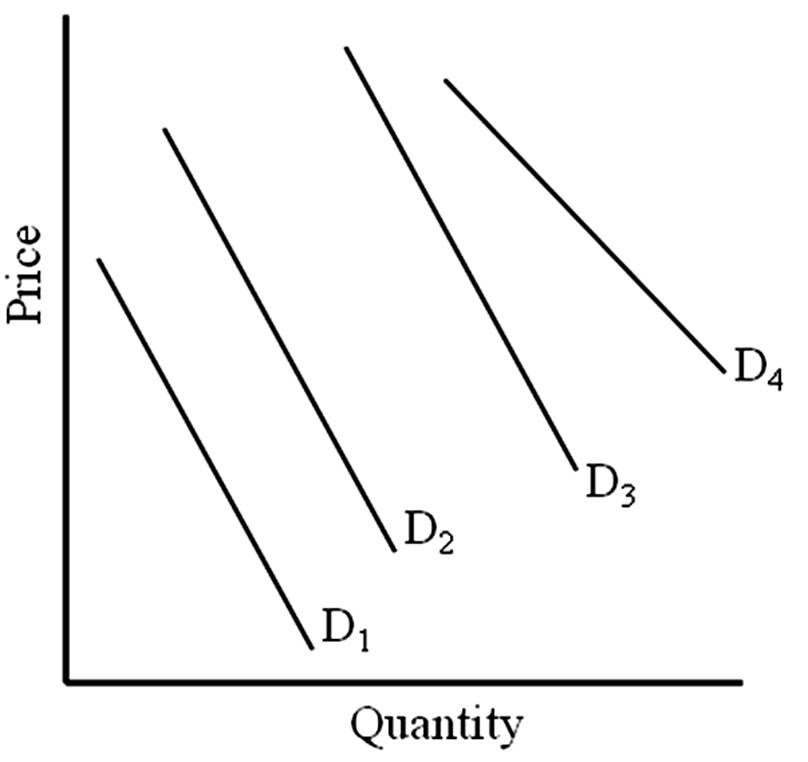

A move from D2 to D3 is a(n) _____.

A. an increase in quantity demanded

B. a decrease in quantity demanded

C. an increase in demand

D. a decrease in demand