Bubbly Bottling Company is engaged in the soft-drink bottling and distribution industry in the states of New York and New Jersey. The firm currently has about 40 percent of the market for these products and related services. Carbonate Distribution

Corporation competes with Bubbly in the same states. Carbonate has about 35 percent of the market. If Bubbly were to acquire the stock and assets of Carbonate, would Bubbly be in violation of any of the antitrust laws? If so, which one? Discuss fully.

The Clayton Act prohibits the type of action by Bubbly suggested in this question—a merger that would increase market concentration. Other factors include the overall concentration of the relevant market, that market's history of tending toward concentration, and whether the merger is apparently designed to establish market power or restrict competition. Based on the facts stated in the question, most of these factors are present. Thus, the major antitrust law being violated is the Clayton Act. The law prohibits any person or business organization from acquiring the stock or assets in another business where the result would be a significantly increased market share and the effect would most likely be to substantially lessen competition. The removal of a competitor who controls 35 percent of the market (Carbonate) combined with the 40 percent held by the acquiring company (Bubbly) definitely could drive out the remaining small competitors and be a barrier to future entrants into this market. Either the U.S. Department of Justice or the Federal Trade Commission could file for divestiture of the resulting firm if these parties were to merge.

You might also like to view...

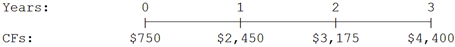

What is the present value of the following cash flow stream at a rate of 8.0%?

A. $7,917 B. $8,333 C. $8,772 D. $9,233 E. $9,695

What elements comprise a store's atmospherics?

What will be an ideal response?

When Texas Instruments first introduced its line of graphing calculators, it set the price quite high; it has lowered the price as competitors have entered the market. The pricing strategy initially used by Texas Instruments is called

A. customary pricing. B. odd-even pricing. C. penetration pricing. D. price skimming. E. prestige pricing.

The point of a table summarizing the data gathered for a report is to convey important trends

Indicate whether the statement is true or false