If the tax multiplier is -1.5 and a $200 billion tax increase is implemented, what is the change in GDP, holding everything else constant? (Assume the price level stays constant.)

A) a $133.33 billion increase in GDP

B) a $133.33 billion decrease in GDP

C) a $30 billion increase in GDP

D) a $300 billion decrease in GDP

E) a $300 billion increase in GDP

D

You might also like to view...

The market implications of taste-based discrimination were in part developed by:

A) Gary Becker. B) Amartya Sen. C) Simon Kuznets. D) Paul Samuelson.

You know an economist has crossed the line from policy adviser to scientist when he or she

a. claims that the problem at hand is widely misunderstood by non-economists. b. makes positive statements. c. talks about values. d. makes a claim about how the world should be.

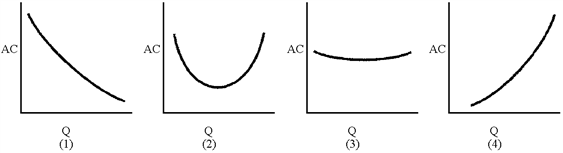

Figure 7-14

Of the long-run AC curves in Figure 7-14, which displays increasing returns to scale for all levels of output?

a.

1

b.

2

c.

3

d.

4

Suppose that 75 percent of a cigarette tax is borne by consumers. If the supply elasticity is 1, the demand elasticity is equal to:

A. 1/2. B. 1. C. 1/3. D. 1/4.