In the Social Security system, the tax receipts from today's workers are

A. used to pay benefits to retired and disabled workers and their dependents today.

B. paid into an account in the employee's name and saved and invested for that individual until he or she retires.

C. all paid into Medicare.

D. paid into the federal government's general revenue to be used for any government expenditure.

Answer: A

You might also like to view...

Suppose that for Halim, the marginal utility of a baseball bat is 50 utils, the marginal utility of a tennis racket is 40 utils, and the marginal utility of an official NFL football is 30 utils. The baseball bat is $35.00, the tennis racket is $200, and the football is $100.00. What can you conclude from this information?

a. Halim will be more inclined to purchase a baseball bat. b. Halim will be more inclined to purchase a tennis racket. c. Halim will be more inclined to purchase a football. d. Halim is in consumer equilibrium regarding the three types of sports equipment.

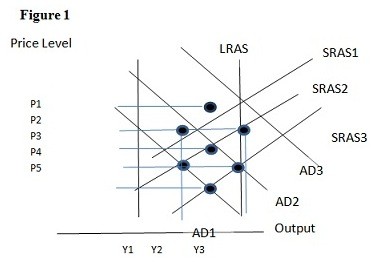

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD3 the result in the long run would be:

A. P2 and Y2. B. P1 and Y2. C. P4 and Y2. D. P1 and Y1.

The gap between labor and the expected Federal Reserve policy interest rate provides a key measure of which of the following:

A. the expected length of a coming global recession. B. the movement of the US stock market. C. the direction of movement of the Euro relative to the US dollar on the foreign exchange market. D. the persistence and intensity of the liquidity crisis.

The goods market equilibrium condition in an open economy shows that

A. Sd = NX - Id. B. NX = Sd - Id. C. Sd = Id - NX. D. Sd = Id.