The average income tax rate is:

a. income taxes divided by income.

b. income divide by income taxes.

c. the change in income taxes when income changes one dollar.

d. the change in income when income taxes change one dollar.

Ans: a. income taxes divided by income.

You might also like to view...

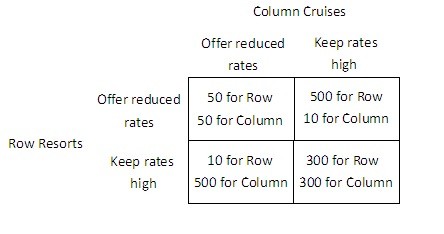

Refer to the figure below.  If Column Cruises offers reduced rates, and Row Resorts keeps its rates high, then Row Resorts will earn ________, and Column Cruises will earn ________.

If Column Cruises offers reduced rates, and Row Resorts keeps its rates high, then Row Resorts will earn ________, and Column Cruises will earn ________.

A. 300; 300 B. 10; 500 C. 500; 10 D. 50; 50

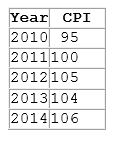

According to the table shown, how do we interpret what happened between 2011 and 2014? The cost of living:

A. increased 6 %.

B. increased 1.06 %.

C. decreased 2 %.

D. decreased 0.98 %.

Suppose that monetary policy becomes more expansionary, and as a result, the future rate of inflation is higher. Will this be good for the stock market?

a. Yes; the inflation will lead to higher wages, and this will be good for both the economy and the stock market. b. No; the inflation will lead to higher nominal interest rates, and this will reduce the present value of the future net earnings derived from stocks. c. Yes; the inflation rate will reduce the long-run rate of unemployment, and this will be good for the stock market. d. No; the expansionary monetary policy will lead to lower real interest rates, and this is generally bad for both the economy and the stock market.

Explain the role that consumers play in perpetuating discrimination in labor markets