A good with an income elasticity of 0.4 is:

A. a normal good.

B. a substitute good.

C. a luxury good.

D. an inferior good.

Answer: A

You might also like to view...

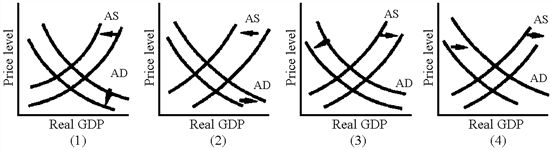

Figure 36-4

?

A. 1 B. 2 C. 3 D. 4

If the federal government where to raise the income tax rates, would this have any impact on a state's cost of borrowing funds? Explain

What will be an ideal response?

Most economists agree that the government should use incomes policies to control inflation during peacetime

a. True b. False Indicate whether the statement is true or false

Recently, there has been talk about reforming the tax system. Some advocate replacing the current income tax with a consumption tax. The income tax taxes interest earned on savings directly, while a consumption tax doesn't. The most likely effect on savings, if there is a shift to the consumption tax, would be to

a. raise interest rates b. shift the supply curve of loanable funds to the left c. encourage higher consumption d. shift the supply curve of loanable funds to the right e. discourage savings