The credit risk a bank faces is the risk resulting specifically from:

A. the economy entering a recession.

B. some of the bank's loans not being repaid.

C. the bank experiencing a decrease in deposits.

D. interest rates falling.

Answer: B

You might also like to view...

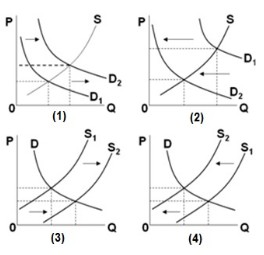

In the diagrams below, the subscript "1" refers to the initial position of the curve, while the subscript "2" refers to the final position after the curve shifts. Which diagram above illustrates the effect on the natural-gas market, with the widespread use of "fracking" or hydraulic fracturing by gas-drilling companies?

Which diagram above illustrates the effect on the natural-gas market, with the widespread use of "fracking" or hydraulic fracturing by gas-drilling companies?

A. (1) B. (2) C. (3) D. (4)

If a firm is losing money, in the short run it

A. will definitely operate. B. will definitely shut down. C. may operate if covering variable costs. D. will definitely go out of business.

Economists would consider a firm with ______ to be making a normal profit.

a. a zero economic profit b. a zero accounting profit c. an economic profit that exceeds its accounting profit d. equal accounting and economic profits

If there are external costs in production and firms do not have to account for these costs, then firms will produce

A. at the efficient level. B. an output level that is below the efficient level. C. an output level that is either above or below the efficient level. D. an output level that is above the efficient level.