Which of the following could be an example of a question that would be studied in microeconomics?

A. Why did our economic growth rate slow down during the 2000s?

B. How did the recession end in 2009 if unemployment continued to rise?

C. How will the legalization of marijuana in Colorado affect the market for cigarettes?

D. When should Congress raise taxes in order to tackle the debt crisis?

C. How will the legalization of marijuana in Colorado affect the market for cigarettes?

You might also like to view...

Federal law required that no two Federal Reserve Board Governors come from the same

A) state. B) political party. C) industry. D) Federal Reserve district.

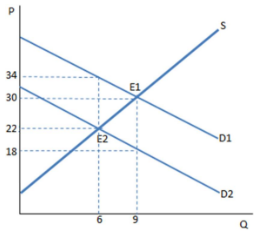

The graph shown demonstrates a tax on buyers. What is the amount of tax revenue being generated from the tax?

A. $72

B. $36

C. $48

D. $96

How do we measure the slope of a linear curve?

What is meant by the term double taxation? a. The tax on corporations is double the rate paid by other forms of business. b. The tax on corporations is one-half the rate paid by other forms of business. c. Corporations must pay both federal and state taxes. d. Corporate profits are taxed, and that portion of profits distributed as dividends is taxed as personal income

e. The corporation pays taxes on stocks and bonds.