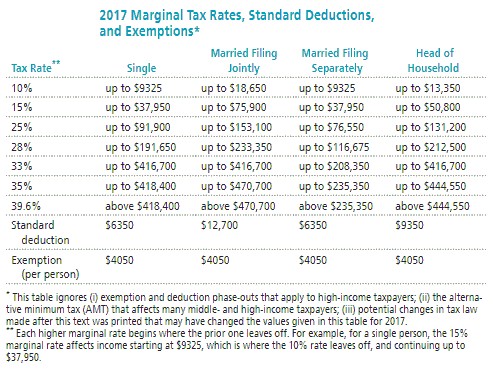

Solve the problem. Refer to the table if necessary. Kelly and Kurt are married filing jointly with a taxable income of $83,634. Calculate the amount of tax owed.

Kelly and Kurt are married filing jointly with a taxable income of $83,634. Calculate the amount of tax owed.

A. $20,909

B. $12,809

C. $9184

D. $12,386

Answer: D

You might also like to view...

Solve.Determine how much of the total loan payment applies toward principal and how much applies toward interest for a home mortgage of $136,538 with a fixed APR of 4.4% for 15 years.

A. $136,538 pays off the principal and $50,340.10 represents interest payments. B. $136,538 pays off the principal and $50,267.78 represents interest payments. C. $136,538 pays off the principal and $50,185.10 represents interest payments. D. $136,538 pays off the principal and $50,219.55 represents interest payments.

Solve the problem.Find cos  , given that cos ? = -

, given that cos ? = -  and ? terminates in 90° < ? < 180°.

and ? terminates in 90° < ? < 180°.

A. -

B.

C.

D. -

Find the exact value of the expression.cos  cos

cos  + sin

+ sin  sin

sin

A.

B.

C.

D. 1

?Using the compound interest tables, answer each of the following questions. ? ?Required: ? a. Pedro has decided he can save $5,000 a year for the next seven years, starting today. What amount will be available seven years from today if the investment account earns 12% compounded annually? b. Anaposa needs $30,000 ten years from today. She has found an investment account that earns 9% compounded annually. How much must she deposit into that account each year for the next ten years, starting today to achieve her investment goal?

Fill in the blank(s) with the appropriate word(s).