Suppose that if your income is $20,000, your tax is $4,000, but if your income is $40,000, your tax is $8,000. Such a tax is

A. Regressive.

B. Proportional.

C. Progressive.

D. A merit tax.

Answer: B

You might also like to view...

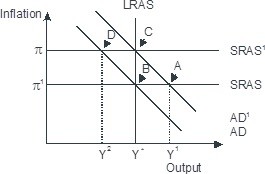

Based on the figure below. Starting from long-run equilibrium at point C, a tax increase that decreases aggregate demand from AD1 to AD will lead to a short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________, if left to self-correcting tendencies.

A. D; C B. D; B C. A; B D. B; C

Any point on the production possibility frontier is

A) attainable and might be allocatively inefficient. B) attainable and must be allocatively efficient. C) less production efficient than a point in the interior of the PPF. D) always allocatively efficient but might or might not be production efficient. E) always production efficient and always allocatively efficient.

Both the crowding-out effect and new classical model indicate that

a. expansionary fiscal policy is a highly effective weapon with which to fight an economic downturn. b. restrictive fiscal policy is a highly effective weapon with which to control inflation caused by excess demand. c. there are side effects of budget deficits that will substantially, if not entirely, offset their expansionary impact on aggregate demand. d. fiscal policy can be used effectively to restrain inflation but it is largely ineffective as a weapon against recession.

According to the law of demand, an increase in the price of baseball trading cards causes:

A. baseball trading cards to grow in abundance. B. the scarcity of baseball trading cards to increase. C. people to buy fewer trading cards. D. people to buy more trading cards.