If the expected path of 1-year interest rates over the next four years is 5 percent, 4 percent, 2 percent, and 1 percent, then the expectations theory predicts that today's interest rate on the four-year bond is

A) 1 percent.

B) 2 percent.

C) 3 percent.

D) 4 percent.

C

You might also like to view...

If the MPC in an economy is 0.8, government could shift the aggregate demand curve rightward by $100 billion by

A. increasing government purchases by $25 billion. B. decreasing taxes by $25 billion. C. increasing government purchases by $80 billion. D. decreasing taxes by $100 billion.

The range of values in which we can be confident that the true regression coefficient lies within a given degree of probability is called a:

A) prediction interval. B) confidence interval. C) logistic regression. D) none of the above.

Which of the following is not one of the three basic situations in which regulation is imposed?

A. price fixing B. natural monopoly C. externalities D. imperfect information

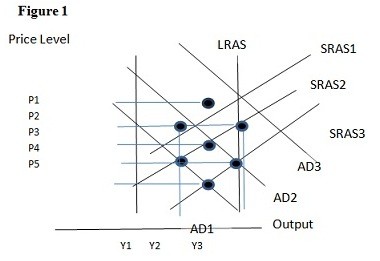

Using Figure 1 above, if the aggregate demand curve shifts from AD3 to AD2 the result in the long run would be:

A. P1 and Y2. B. P2 and Y1. C. P3 and Y1. D. P3 and Y2.