If the annual interest rate printed on the face of a bond is 25 percent, the face value of the bond is $1,000, and the current market price of the bond is $700, what is the current yield on the bond?

A. 25.5 percent.

B. 20.5 percent.

C. 25.0 percent.

D. 35.7 percent.

Answer: D

You might also like to view...

The three concepts of optimal capacity utilization are:

a. optimal plant size for a given output rate b. optimal cost of manufacturing c. optimal plant size d. optimal output for a given plant size e. all of these except b f. all of these except c

John Maynard Keynes wrote that economies can suffer recession or depression for many years if the government does not intervene

a. True b. False Indicate whether the statement is true or false

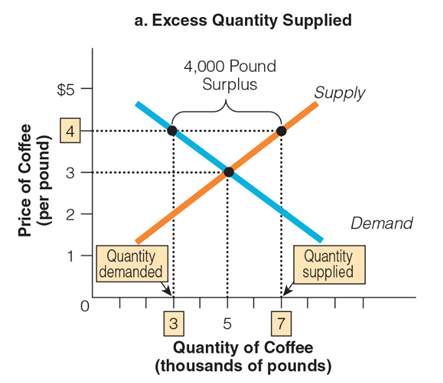

What would happen if you decreased the price to $2 and decreased the quantity supplied to 4,000 pounds?

a. You would create a shortage.

b. You would maintain the same surplus.

c. You would reach equilibrium.

d. You would reduce the surplus.

According to supply-side theory, which of the following would cause a rightward shift in the aggregate supply curve?

A. Eliminating government-funded training programs for the structurally unemployed. B. Increasing transfer payments to the unemployed. C. Eliminating job search assistance. D. Lifting trade restrictions.