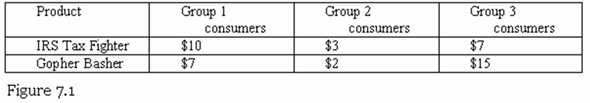

Tax Fighters, Inc., develops, markets, and sells software for tax preparation. Tax Fighters, Inc. sells IRS Tax Fighter, a software for completing federal income tax forms and Gopher Basher, a software for completing Minnesota state income tax forms. For simplicity, assume that all of the costs in this industry are the fixed costs of developing the software packages themselves. The marginal cost of producing another disk is approximately zero.Consider the following information about the demand for tax software. There are an equal number of consumers in each group. Figure 7.1 shows the maximum that each type of consumer is willing to pay for each product. As vice president for pricing, explain your optimal bundling and pricing strategy to maximize Tax Fighter profits from the sale of tax

software. Be sure to clearly explain why your strategy is optimal.

What will be an ideal response?

Group 2 consumers have very low willingness to pay. It is more profitable to try to sell to Group 1 and Group 3 consumers. We can exploit the relative preference of Group 1 consumers for Tax Fighter and the relative preference of Group 3 consumers for Gopher Basher through bundling the two products for $17.

If we priced each item individually, we could only charge $7 for IRS Tax Fighter in order to entice 2/3 of the customers to buy the product. We could only charge $7 for Gopher Basher and still have 2/3 of the consumers to buy Gopher Basher. However, we can get $17 in revenue out of both Group1 and Group 2 customers by offering only a $17 bundle of both tax programs, instead of the lower $14 of revenue we would receive from selling each program separately. Let n be the number of customers in each group.

If P = $17, then TR = $17 x 2n = 34n.

If P = $7, then TR = $7 x 3n = 21n.

If P = $22, then TR = $22n.

So $17 is the best bundled price.

For nonbundled pricing

$7 for each product; then TR is $7 x 2n + $7 x 2n = 28n.

$4 for first and $3 for second; then TR is $4 x 3n + $3 x 3n = 21n.

So if n people are in each group, profits and total revenue are both maximized by charging $17 for the two software products as a single bundle, given the firm's extra revenue of 34n.

You might also like to view...

The number of dollars that the commercial banking system can add to the money supply for each dollar of new reserves created by the Fed

A) cannot legally be greater than 8 nor less than 2. B) is governed largely by reserve requirements and the form in which the public chooses to hold money. C) is less than one because a portion of new reserves must be retained in bank vaults or on deposit with the Fed. D) would increase if the public decided to transfer the amounts currently in commercial bank savings accounts into checking accounts.

In the very short run ________

A) the real interest rate will be affected by changes in the nominal rate B) monetary policy has an immediate effect on inflation C) the inflation rate is determined by the federal funds rate D) all of the above E) none of the above

A similarity between monopoly and perfect competition is that both types of firms are able to earn economic profits in the short run.

Answer the following statement true (T) or false (F)

If the MPS is 0.5, the tax multiplier is

A. -5. B. -2. C. -1. D. -0.5.