Suppose that in a certain nation the flat income tax rate of 40 percent is reduced to 35 percent and as a result the tax base rises from $400 billion to $600 billion. As a result, ax revenues __________, indicating the nation is on the __________ portion of its Laffer curve

A) rise; upward-sloping

B) rise; downward-sloping

C) fall; upward-sloping

D) fall; downward-sloping

B

You might also like to view...

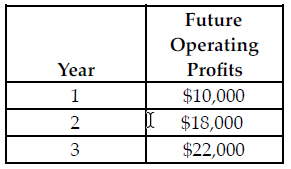

Refer to the table below. If the discount rate is 4 percent and the cost of the investment is $40,000, what is the net present value of the investment?

The above table shows the future operating profits from an investment. The future operating profits are earned at the end of each of the respective years.

A) $44,469.77

B) $5,815.32

C) $45,815.32

D) $6,221.77

Refer to the above figure. The profit maximizing quantity for this firm is

A) zero. B) Q1. C) Q2. D) Q3.

In a world where capital moves rapidly across national boundaries, if a larger budget deficit leads to higher real interest rates,

a. there will be an inflow of foreign capital, which will cause the dollar to appreciate and net exports to decline. b. there will be an outflow of foreign capital, which will cause the dollar to depreciate and net exports to increase. c. there will be an inflow of foreign capital, which will cause the dollar to depreciate and net exports to increase. d. there will be an outflow of foreign capital, which will cause the dollar to appreciate and net exports to decline.

Why is a discounted airline fare a price discrimination that can be offered?

(A) Because people who fly on business want the price discounts but do not qualify. (B) Because senior citizens qualify for discounts on certain types of flights but not on others. (C) Because people do not necessarily want to go where the discounts will allow them to go. (D) Because vacationers are willing to put up with the restrictions that the airlines impose.