Assume that yields on bonds (rate of return) begin to fall while the stock market is booming, what should we see happen to the demand and price of stocks and why?

What can we say about the opportunity cost of holding on to bonds in this situation?

Lower bond yields will push many investors into stocks where they are seeking a higher rate of return. This should increase the demand for stocks and push up asset prices as well. The opportunity cost of holding on to bonds is high compared to owning stocks.

You might also like to view...

Refer to Figure 4.8. If half of your friends go to the beach and half go to the park, and you decide to go to the park, then

A) your friends at the beach will switch to the park. B) you and your friends at the park will switch to the beach. C) your friends at the beach will switch to the park and your friends at the park will switch to the beach. D) your friends will all stay where they are.

If national income = $1,000 . autonomous consumption = $200, the MPC = 0.80, and intended investment demand is $200, then actual investment will

a. equal intended investment, and the economy will be in equilibrium b. be less than intended investment, and production and incomes will grow c. be greater than intended investment, and production and incomes will fall d. be less than intended investment, and production and incomes will fall e. be greater than intended investment, and production and incomes will grow

The inflation rate is:

A. the percentage change in the overall price level. B. is not something that can be accurately measured with the CPI. C. the central concept in microeconomics. D. a measure of the rate of increase in the cost of imported goods.

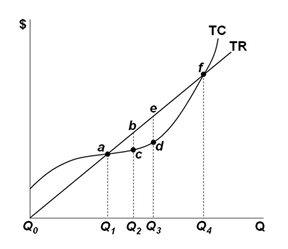

Refer to the graph below. Which of the output levels is the profit-maximizing output level for this firm?

A. Q1

B. Q2

C. Q3

D. Q4