When we compare the graphs of GDP growth over time to the corresponding risk spread on Baa bonds compared to 10-year U.S. Treasury bonds, what relationship can be inferred?

What will be an ideal response?

There seems to be an inverse relationship between GDP growth and the size of the risk spread. As GDP growth slows, the risk spread increases and vice versa.

You might also like to view...

The Sherman Act and the Clayton Act were passed into law more than 100 years ago. What characteristic of each of these laws enables them to remain applicable in today's modern economy?

What will be an ideal response?

Utility possibility frontier shows:

a. the possible combinations of utility that an efficient bargain can get the negotiating parties. b. the exact bargain at which the negotiating parties eventually arrive. c. the highest utility each negotiating party can individually achieve. d. the possible combinations that maximize payoffs to the negotiating parties.

If a firm is able to charge a higher price for its output, all else equal, the value of the marginal product of labor will decrease to offset the higher price

a. True b. False Indicate whether the statement is true or false

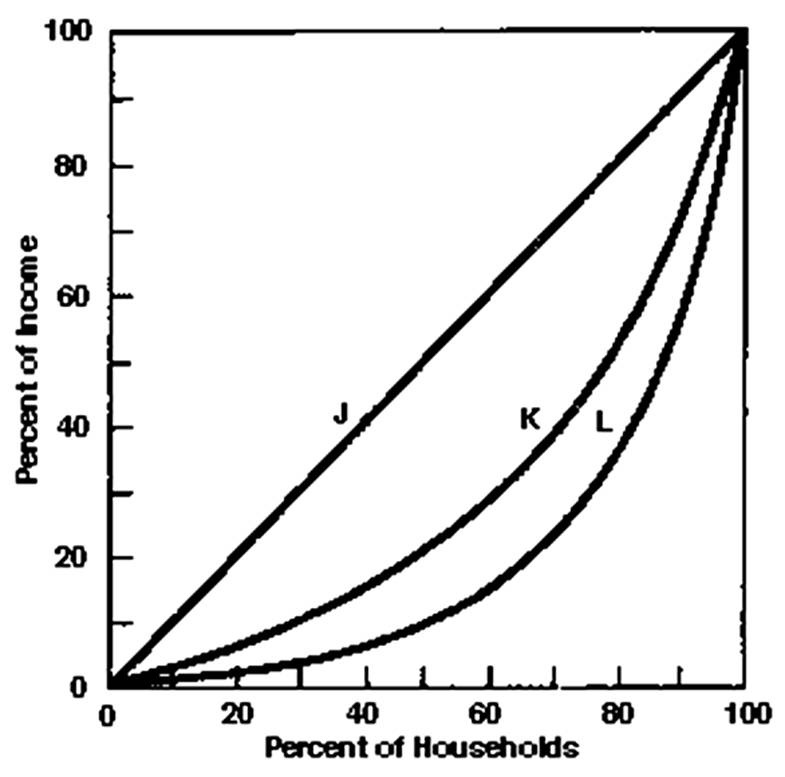

What is the percentage of income received by the lower three quintiles on line K?