Why is the real-world deposit multiplier smaller than 1/RR, where RR is the required reserve ratio?

What will be an ideal response?

There are two reasons why the real world multiplier is smaller than the deposit multiplier, 1/RR. First, banks do not loan out all their excess reserves. Banks like to keep some excess reserves on hand in case withdrawals are higher than the bank might typically expect. If this is the case, then the amount of money that is available to loan out in the next round is a bit smaller. This will shrink the amount of money expansion. Second, not all money that is loaned out in the money expansion process is put back into the banking system. Some of it leaks out in the form of currency and does not get entirely redeposited. Both of these actions make the money expansion smaller.

You might also like to view...

Dan missed class the day the professor covered the circular flow model. Dan asked his friend Joan to explain markets to him. Joan correctly stated that a market

A) must have many buyers and only one seller, who is willing to sell to all the buyers. B) is only a place to purchase groceries. C) requires a physical location for buyers and sellers to get together. D) must include a written contract between buyers and sellers. E) is any arrangement that brings buyers and sellers together.

Suppose the marginal tax rate is 37 percent for an income level of $50,000 and 39 percent for an $80,000 income. This implies that the underlying tax structure is _____ in nature

a. fixed b. progressive c. regressive d. lump-sum e. proportional

As a monopoly increases production, the price of all units sold falls, but marginal revenue increases

a. True b. False Indicate whether the statement is true or false

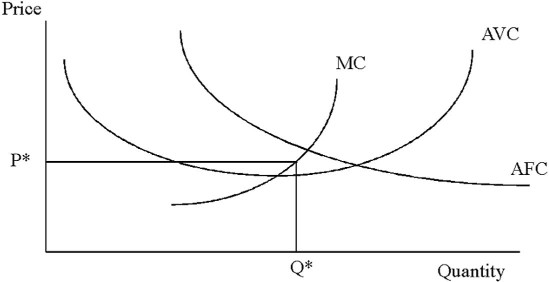

In the graph below if the price persists at P*, the profit maximizing firm will

A. shut down immediately. B. shut down in the long run. C. have a strategy that cannot be predicted without an ATC curve. D. operate indefinitely.