Assume the current market futures price is 1.66 A$/$. You borrow 167,000 A$, convert the proceeds to U.S. dollars, and invest them in the U.S. at the risk-free rate. You simultaneously enter a contract to purchase 170,340 A$ at the current futures price (maturity of 1 year). What would be your profit (loss)?

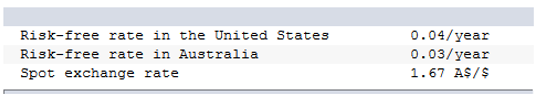

Consider the following:

A. Profit of 630 A$

B. Loss of 2300 A$

C. Profit of 2300 A$

D. Loss of 630 A$

A. Profit of 630 A$

[A$167,000/1.67 × 1.04 × 1.66] ? (A$167,000 × 1.03) = A$630.

You might also like to view...

How should a country respond when foreign investors withdraw investments from that country?

What will be an ideal response?

implementation of mindful meditation programs is estimated to increase employee productivity each year by ______.

A. $6,000 per employee B. $5,000 per employee C. $2,000 per employee D. $3,000 per employee

Availability of funds is not a criterion for deciding on capital investment proposals

Indicate whether the statement is true or false

Sara is retiring next month. In addition to all the planning for her retirement party, the company has published an in-house advertisement for anyone who wants to apply for her job. This recruitment method is known as ______.

A. open recruitment B. targeted recruitment C. closed recruitment D. employee referrals