If investors showed less of a preference for investing in war-related companies, then it would be expected that the stock prices for those companies would:

A. Increase, and the rates of return would decrease relative to other companies

B. Decrease, and the rates of return would increase relative to other companies

C. Decrease, but the rates of return would stay the same relative to other companies

D. Decrease, and the rates of return would decrease relative to other companies

B. Decrease, and the rates of return would increase relative to other companies

You might also like to view...

Limit pricing is also referred to as

A) competitive pricing B) fair pricing C) predatory pricing D) all of these choices.

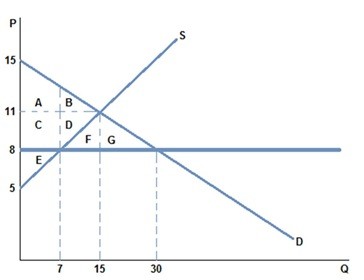

After a price ceiling of $8 is placed on the market in the graph shown, which area represents total surplus?

After a price ceiling of $8 is placed on the market in the graph shown, which area represents total surplus?

A. A + B + C + D + E B. A + B + C + D + E + F + G C. A + C + E D. A + B + C + D + E + F

The marginal propensity to consume is

a) consumption divided by disposable income b) national income divided by consumption c) the change in national income caused by a $1 change in consumption d) the change in consumption caused by a $1 change in disposable income e) the percentage increase in consumption caused by a 1% decrease in savings

Which of the following examples shows a decrease in total revenue for an elastic price demand?

a. When the price of saws increases by 5 percent, the quantity demanded decreases by 9 percent. b. When the price of nails decreases by 10 percent, the quantity demanded increases by 15 percent. c. When the price of wrenches increases by 8 percent, the quantity demanded decreases by 5 percent. d. When the price of pliers decreases by 3 percent, the quantity demanded increases by 5 percent.