Refer to Figure 10.3. A negative demand shock with no change in the real interest rate is best represented by ________ in panel (a) and ________ in panel (b)

A) a shift from AE3 to AE2; a shift from IS2 to IS1

B) a shift from AE2 to AE3; a shift from IS1 to IS2

C) a shift from AE2 to AE1; a movement from point B to point A

D) a shift from AE3 to AE1; a movement from point C to point A

A

You might also like to view...

Assume that Brazil and Mexico have floating exchange rates. All else held constant, if the price level is stable in Mexico but Brazil experiences rapid inflation then ________.

A. the Brazilian real will appreciate B. the Brazilian real will depreciate C. gold bullion will flow into Brazil D. the Mexican peso will depreciate

If supply is upward-sloping and demand is downward sloping, what happens to the equilibrium real risk-free interest rate and quantity of real loanable funds per time period if there is a decrease of financial international capital flows into a nation:

a. The real risk-free interest rate rises and the quantity per time period falls. b. The real risk-free interest rate rises and the quantity per time period rises. c. The real risk-free interest rate falls and the quantity per time period falls. d. The real risk-free interest rate rises and the quantity per time period does not change. e. The real risk-free interest rate rises and the quantity per time period is uncertain.

Suppose the demand for good X is given by Qdx = 10 - 2Px + Py + M. The price of good X is $1, the price of good Y is $10, and income is $100. Given these prices and income, how much of good X will be purchased?

A. 115. B. 1,000. C. 515. D. None of the statements associated with this question are correct.

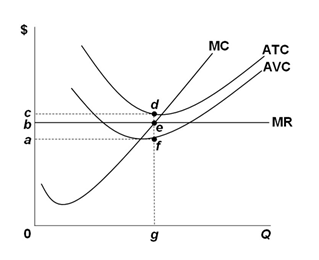

Refer to the graph below for a purely competitive firm operating at a loss in the short run. Which area in the graph represents the amount of economic loss for the firm?

A. 0beg

B. bcde

C. acdf

D. abef