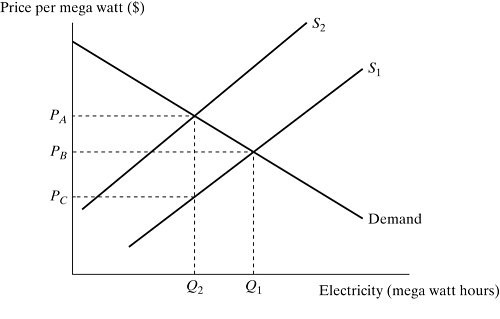

Figure 16.3Figure 16.3 depicts a market for electricity. S1 is the supply curve without the external costs. S2 is the supply curve with the $T tax. Assume electricity production incurs external costs. If the government imposes the pollution tax in the amount illustrated, the amount of the pollution tax shifted forward on to consumers is:

Figure 16.3Figure 16.3 depicts a market for electricity. S1 is the supply curve without the external costs. S2 is the supply curve with the $T tax. Assume electricity production incurs external costs. If the government imposes the pollution tax in the amount illustrated, the amount of the pollution tax shifted forward on to consumers is:

A. PA - PB.

B. PA - PC.

C. PB - PC.

D. (1/2)?(PB - PC).

Answer: A

You might also like to view...

Consumption expenditures include all of the following EXCEPT

A) going to a concert. B) having your house cleaned by Klean Maids. C) buying a pizza. D) purchasing a share of stock.

If the federal government wishes to move the economy out of a recessionary gap, the appropriate fiscal policy is a(n)

a. increase in taxes. b. decrease in government purchases. c. decrease in transfer payments. d. None of the above are correct.

To adjust from Net National Product to Gross National Product:

a) Add depreciation b) Deduct indirect taxes c) Add subsidies d) Add inflation

Which of the duopoly models has the lowest overall combined profit level?

A. The Bertrand model B. The shared monopoly model C. The Cournot model D. The Stackelberg Leader-Follower model