If the crowding-out effect is complete and the marginal propensity to save is 0.25, then an increase in government spending of $100 billion will generate how much more real GDP?

A) $0 B) $400 billion C) $25 billion D) $100 billion

A

You might also like to view...

Which of the following is a primary implication of the accelerator theory of investment?

A) Net investment occurs when the desired and actual capital stocks are equal. B) In order for gross investment to remain constant, income must remain constant. C) Rising rather than high levels of output are necessary to maintain a high level of net investment. D) B and C are both correct.

A merger between a shoelace company and a soup company might be undertaken to

a. eliminate a potential competitor b. enhance a supplier-purchaser relationship c. diversify assets and production d. raise the Herfindahl-Hirschman Index in the shoelace industry e. raise the concentration ratio in the soup industry

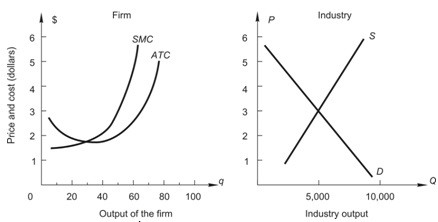

Below, the graph on the left shows the short-run cost curves for a firm in a perfectly competitive market, and the graph on the right shows the current market conditions in this industry. What do you expect to happen in the long-run?

A. Market supply will decrease. B. Market price will decrease. C. The firm's profit will decrease. D. both b and c E. all of the above

You sell your good in a perfectly competitive market where the market price is $7.00. When you sell 100 units your total revenue is $700. When you sell 101 units:

A. total revenue increases by less than $7. B. total revenue increases by exactly $7. C. total revenue increases by more than $7. D. total revenue may increase or decrease.