Social Security payroll taxes are

A. proportional with a rate of 7.65 percent.

B. indirect taxes.

C. progressive because total taxes increase with income.

D. regressive because the tax is not applied after reaching an income threshold.

Answer: D

You might also like to view...

________ in the foreign interest rate causes the demand for domestic assets to ________ and the domestic currency to appreciate, everything else held constant

A) An increase; increase B) An increase; decrease C) A decrease; increase D) A decrease; decrease

Which statement is false?

A. The unemployment rate for blacks has consistently been double that of whites. B. The largest source of income is property income. C. Women have traditionally earned 60% of what men have earned. D. None of these statements are false.

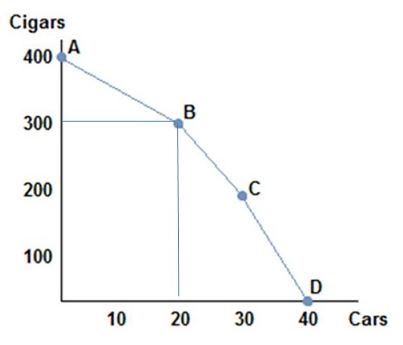

Consider the production possibilities frontier in the figure shown. The opportunity cost of moving from point A to point B is:

A. 5 cars per cigar.

B. 10 cars per cigar.

C. 5 cigars per car.

D. 10 cigars per car.

How does the introduction of cognition into a consumer's choice between consumption now and saving affect marginal utility per dollar, the amount spent on consumption now, and the amount saved? Assume utility is maximized.

What will be an ideal response?