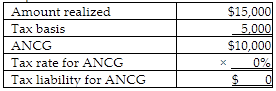

Sanjay is single and has taxable income of $23,000 without considering the sale of a capital asset in November of 2018 for $15,000. That asset was purchased six years earlier and has a tax basis of $5,000. The tax liability applicable to only the capital gain is

A) $0.

B) $500.

C) $1,200.

D) $1,500.

A) $0.

You might also like to view...

Geocentric companies are integrated on a global scale

Indicate whether the statement is true or false

The post-closing trial balance must be prepared from the balances on the work sheet

Indicate whether the statement is true or false

Answer the following statements true (T) or false (F)

1. Seeing other guests enjoying their meals enhances a guest’s dining experience since happiness and satisfaction are contagious. 2. An information-rich environment is preferable when guests need to make many decisions. 3. Every aspect of the service environment should be managed; nothing should be left to chance. 4. One way to help guests cope with information overload is to use cues like smells or sounds that recall memories for them to respond appropriately to a service setting.

The following costs relate to Tower Company: Variable manufacturing cost, $30; variable selling and administrative cost, $8; applied fixed manufacturing overhead, $15; and allocated fixed selling and administrative cost, $4. If Tower uses absorption manufacturing-cost pricing formulas, the company's markup percentage would be computed on the basis of:

A. $30. B. $57. C. $38. D. $45. E. None of the answers is correct.