Which of the following can the government use as a tool of fiscal policy if it wants to increase the level of real GDP in the economy?

A. An increase in government expenditure

B. A decrease in government expenditure

C. A cut in taxes

Answer: A & C.

A. An increase in government expenditure

C. A cut in taxes

You might also like to view...

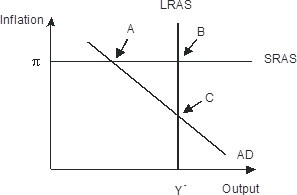

The economy pictured in the figure below has a(n) ________ gap with a short-run equilibrium combination of inflation and output indicated by point ________.

A. recessionary; B B. recessionary; C C. recessionary; A D. expansionary; A

Assuming no change in the effective tax rate on capital, a decrease in the government budget deficit will reduce the current account deficit if and only if the decrease in the budget deficit

A) reduces desired national saving. B) increases desired national saving. C) reduces desired national investment. D) increases desired national investment.

At an output level of 100, a monopolist faces MC = 15 and MR = 17. At output level q = 101, the monopolist's MC = 16 and MR = 15. To maximize profits, the firm

A) should produce 100 units. B) should produce 101 units. C) cannot maximize profits. D) is not a monopoly.

If we take the production function and hold the level of output constant, allowing the amounts of capital and labor to vary, the curve that is traced out is called:

A) the total product. B) an isoquant. C) the average product. D) the marginal product. E) none of the above