If the central bank can act as a lender of last resort during a banking panic, banks can

A) call in their loans to their customers and eventually restore the public's faith in the banking system.

B) satisfy customer withdrawal needs and eventually restore the public's faith in the banking system.

C) borrow more and more money from the central bank, and this will lower its reserves and decrease the public's faith in the banking system.

D) encourage the public to borrow directly from the central bank, and this will worsen the banking panic.

B) satisfy customer withdrawal needs and eventually restore the public's faith in the banking system.

You might also like to view...

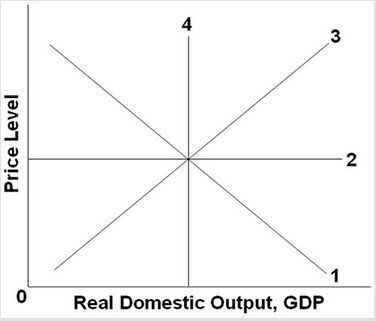

Use the following graph to answer the next question. Which line represents the long-run aggregate supply curve?

Which line represents the long-run aggregate supply curve?

A. 1 B. 2 C. 3 D. 4

What allocation method is the primary method used in the United States?

What will be an ideal response?

Some economists have argued that path dependence and switching costs can lead to market failure. Which of the following is an example of this argument?

A) VHS video recorders became more popular with consumers than Sony Betamax recorders even though the Betamax recorders embodied a superior technology. B) A consumer who won a lottery for a Super Bowl ticket refuses to sell it for $3,000 even though he would not have paid $3,000 for a ticket if he had not won the lottery. C) Costly celebrity endorsements lead many consumers to buy a product even though it is more expensive or less effective than a product that is not endorsed by a celebrity. D) While playing the ultimate game, an allocator decides to share $20 equally with a recipient rather than keep the $20 for herself.

Sources of stress include all but which of the following:

a. Hurricanes, tornadoes, floods and other such natural events b. Angry family members and friends c. Clutter, mental and physical d. All of the above are potential sources of stress