The term “tone at the top” is typically associated with a firm’s control environment. How would you characterize Société Générale’s tone at the top and what effect do you believe that had on oversight at the trading-desk level?

What will be an ideal response?

Students’ responses will vary and should include a negative or weak view of the control environment.

Some of the factors in the case linked to control environment are listed below.

The bank’s leadership knew that controls were not as strong as they should have been, but they put

profits first.

In meetings with investors in recent days, Société Générale’s chief executive officer, Daniel

Bouton, has admitted his bank’s internal systems did not keep up with the pace of growth in the

derivatives business. “He told them while our derivatives business was going 130 miles an hour, risk control was only going 80,” according to one analyst who covers Société Générale but insisted on

anonymity.1

Leadership encouraged risk-taking bets as long as they were profitable.

Kinner Lakhani, an analyst with ABN Amro in London: said, “Unlike some of their peers,

Société Générale was not shy about taking proprietary trading risks. Perhaps such businesses grew

faster than risk management could cope.”

Within Société Générale’s corporate and investment bank, according to Mr. Lakhani, the

percentage of revenue from market-making and proprietary trading rose to about 35 percent by mid-

2007 from 29 percent in 2004.

“If this scam had been uncovered in November, when he [Kerviel] was still up, he would have

been fired but I suspect we would have heard very little about it,” The damage wrought by Mr. Kerviel

comes in the wake of two trends that reshaped Société Générale: the explosive growth of its derivatives

business and its use of its own money to make bets on the market, known as proprietary trading.1

Société Générale had a poor tone at the top and should have led auditors to increase the inherent risk of

the audit. Management had been known to encourage risk above that which should have been accepted.

Throughout Société Générale’s sprawling derivatives business, said one current employee

who used to work with Mr. Kerviel, traders were encouraged to make proprietary bets, even on

desks that specialized in what top executives called “plain vanilla products,” like the team where Mr.

Kerviel worked, Delta One. “You must take positions, even if you are not a proprietary trader,” said

this employee, who insisted on anonymity because he was not authorized to talk to the press. “During

appraisals by bosses, they made it clear you were judged by how well you did your basic job, as well as

how much money you made on prop trades.”2

This attitude of management prompted traders to take unnecessary risk, which was not part of their

job descriptions. This attitude bred competition between traders and traders began to bend and break

the rules, as Kerviel did, just to get ahead.

Bank leadership was slow to replace the manager of the Delta One trading desk, leaving the trading

desk with little effective control. Further, when a replacement manager was hired, he apparently was

inadequately trained as he did not carry out any detailed analyses of traders’ earnings or positions.

Other factors student’s responses may include:

à Management ignored red flags, both external (Eurex) and internal (75 alerts)

à When supervisors or risk-management officers found errors, Kerviel was allowed to “fix” them

without further investigation

à Another employee knew about it (Bakir) but didn’t report it—suggesting a lack of ethical leadership

and perhaps management’s tolerance for ignoring the rules.

In order to bolster controls after the discovery of the fraud, Société Générale has set up a dedicated

internal fraud investigation group of around 20 people that will be independent of the front- and back-

office operations. The security of its computer systems has also been enhanced, making it more difficult for

employees to borrow the logins and passwords of colleagues.

You might also like to view...

The economic environment includes public policies, laws, government agencies, and pressure groups that influence and regulate various organizations and individuals in society

Indicate whether the statement is true or false

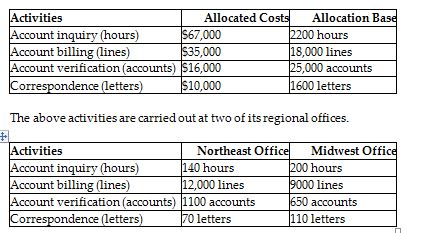

Atomic Microwave Company, a manufacturer of microwave ovens, had the following activities, allocated costs, and allocation bases:

How much of the account verification costs will be assigned to the Northeast Office? (Round any intermediate calculations to the nearest cent and your final answer to the nearest dollar.)

A) $416

B) $70

C) $704

D) $90

What is a payment-in-kind bond?

What will be an ideal response?

An assignment is valid from the moment it is made, regardless of whether the assignor notifies the obligor.

Answer the following statement true (T) or false (F)