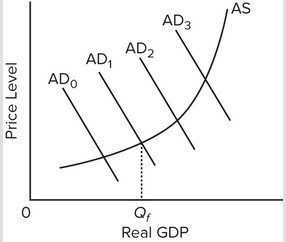

Use the following graph to answer the next question. In the diagram, Qf is the full-employment output. An expansionary fiscal policy would be most appropriate and needed if the economy's present aggregate demand curve were at

In the diagram, Qf is the full-employment output. An expansionary fiscal policy would be most appropriate and needed if the economy's present aggregate demand curve were at

A. AD0.

B. AD1.

C. AD2.

D. AD3.

Answer: A

You might also like to view...

If a nation has a higher level of technology than another nation it can produce:

A. more outputs with the same level of physical capital. B. less with the same amount of physical capital. C. more with no use of human capital. D. the same output with the same level of inputs.

When investors become irrationally optimistic that an asset's price will continue to rise, it causes a financial bubble to:

A. start to inflate. B. be on the verge of bursting. C. burst. D. become doubted by most serious investors.

Under the rational expectations hypothesis, which of the following is the most likely short-run effect of a move to expansionary monetary policy?

A. a higher general level of prices but no change in real output B. a higher general level of prices and an expansion in real output C. no change in the general level of prices and a reduction in real output D. no change in either the general level of prices or real output

As market interest rates rise, people want to hold smaller cash balances, which means that the existing stock of money circulates faster and velocity rises.

Answer the following statement true (T) or false (F)