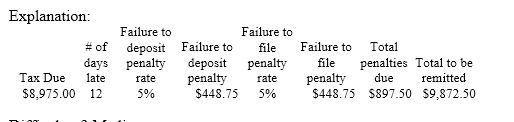

Faith, the accountant for Harris's Meats, filed Form 941 for the first quarter on May 12. The amount of taxes due to be paid with Form 941 was $8,975. The first failure to file notice was dated May 5. What is the amount that must be remitted, including the IRS penalty for the failure to file?

A) $8,975.00

B) $9,154.50

C) $9,423.75

D) $9,872.50

D) $9,872.50

You might also like to view...

Which of the following events tactics is recommended to a firm whose marketing objective is to

build brand awareness? A) organizing hospitality tents at events B) throwing launch parties C) giving away samples at an event D) increasing merchandising and promotion efforts

Usuryx Co charges interest on all credit. On its credit application form the term is stated as "interest on unpaid balance over 30 days at 1% per month." Slident Co has an amount owning beyond the 30 days period

Which of the following statements is TRUE? A) Slident will have to pay interest at the rate of 1% per month. B) Slident will have to pay interest at the rate of 5% per annum. C) Slident will not have to pay any interest because the term violates the Interest Act. D) Slident will have to pay interest at 12% per annum. E) Slident will have to pay interest at 12% annually but not any administration costs.

Weston, Inc., produces widgets. To manufacture a new type of widget, it took 18 iterations before the process reached a steady state of 3 hr. If Weston has an 86% learning rate, use the logarithmic approach to calculate the time it took to manufacture the first widget.

A. 7.30 hr B. 4.44 hr C. 5.63 hr D. 5.11 hr

The statute of limitations for a tax return does not begin to run until the return is filed.

Answer the following statement true (T) or false (F)