The accountant for the Hilga Company recorded a purchase of merchandise on credit for the current year, but the merchandise was shipped FOB destination and did not arrive until after current year-end. Assuming a periodic inventory system, how would assets, liabilities, and retained earnings be affected on the year-end balance sheet? Assets Liabilities Retained Earnings I. No effect Understated

Understated II. Understated Understated Understated III. No effect Overstated Overstated IV. No effect Overstated Understated ?

A) I

B) II

C) III

D) IV

D

You might also like to view...

Mini-Case Question. What is the relative product performance index for PrintWorth Inc.?

A) 100 B) 130 C) 25 D) 48 E) 62.9

Oil and gas reserves information would be included within the financial statements

Indicate whether the statement is true or false

Portia Grant is an employee who is paid monthly. For the month of January of the current year, she earned a total of $8738.00. The FICA tax for social security is 6.2% of the first $128,400 earned each calendar year and the FICA tax rate for Medicare is 1.45% of all earnings. The FUTA tax rate of 0.6% and the SUTA tax rate of 5.4% are applied to the first $7000 of an employee's pay. The amount of federal income tax withheld from her earnings was $1449.87. What is the total amount of taxes withheld from the Portia's earnings? (Round your intermediate calculations to two decimal places.)

A. $2118.33 B. $2552.33 C. $2172.00 D. $3621.87 E. $1576.57

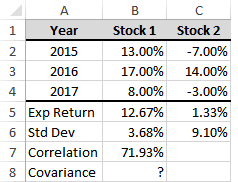

Which formula/function is the correct one to calculate the covariance in B8?

a) =COVARIANCE.P(B2:B4,C2:C4)

b) =B7*B6*C6

c) =((B2-B5)*(C2-C5)+(B3-B5)*(C3-C5)+(B4-B5)*(C4-C5))/3

d) =CORREL(B2:B4,C2:C4)*STDEVP(B2:B4)*STDEVP(C2:C4)

e) All of the above