If the Fed raises the reserve requirement on deposits from 15 percent to 20 percent, what would happen to the money supply?

a. It would decrease.

b. It would increase.

c. It would remain unchanged.

d. It depends on the value of interest rates.

a

You might also like to view...

Interest earned on personal savings accounts is currently subject to taxation. What may happen to economic growth in the United States if Congress passes legislation exempting this interest from taxation?

If Gross Domestic Product (GDP) and other national income accounts are expressed in nominal values, then they are

A. measured in constant prices instead of actual market prices. B. measured in real values. C. readily comparable to Gross Domestic Product (GDP) figures for other years. D. measured in market prices at which goods actually sold.

Small-denominated time deposits, by definition:

A. mature in one month or less. B. mature in one year or less. C. are less than $100,000. D. are held by state and local banks only.

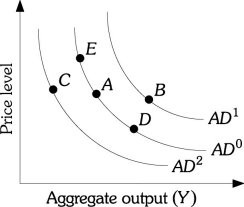

Refer to the information provided in Figure 27.1 below to answer the question(s) that follow. Figure 27.1Refer to Figure 27.1. Suppose the economy is at Point A. An increase in taxes can cause a movement to Point

Figure 27.1Refer to Figure 27.1. Suppose the economy is at Point A. An increase in taxes can cause a movement to Point

A. E. B. B. C. C. D. D.